Through the establishment of "carbon markets" accessible to governments and companies and the democratisation of "voluntary offsetting", carbon finance has become a powerful and complex instrument for climate protection. If properly implemented, i.e. preceded by a drastic reduction in GHG emissions, the mechanics of carbon finance are currently the only effective way to raise funds on a large scale.

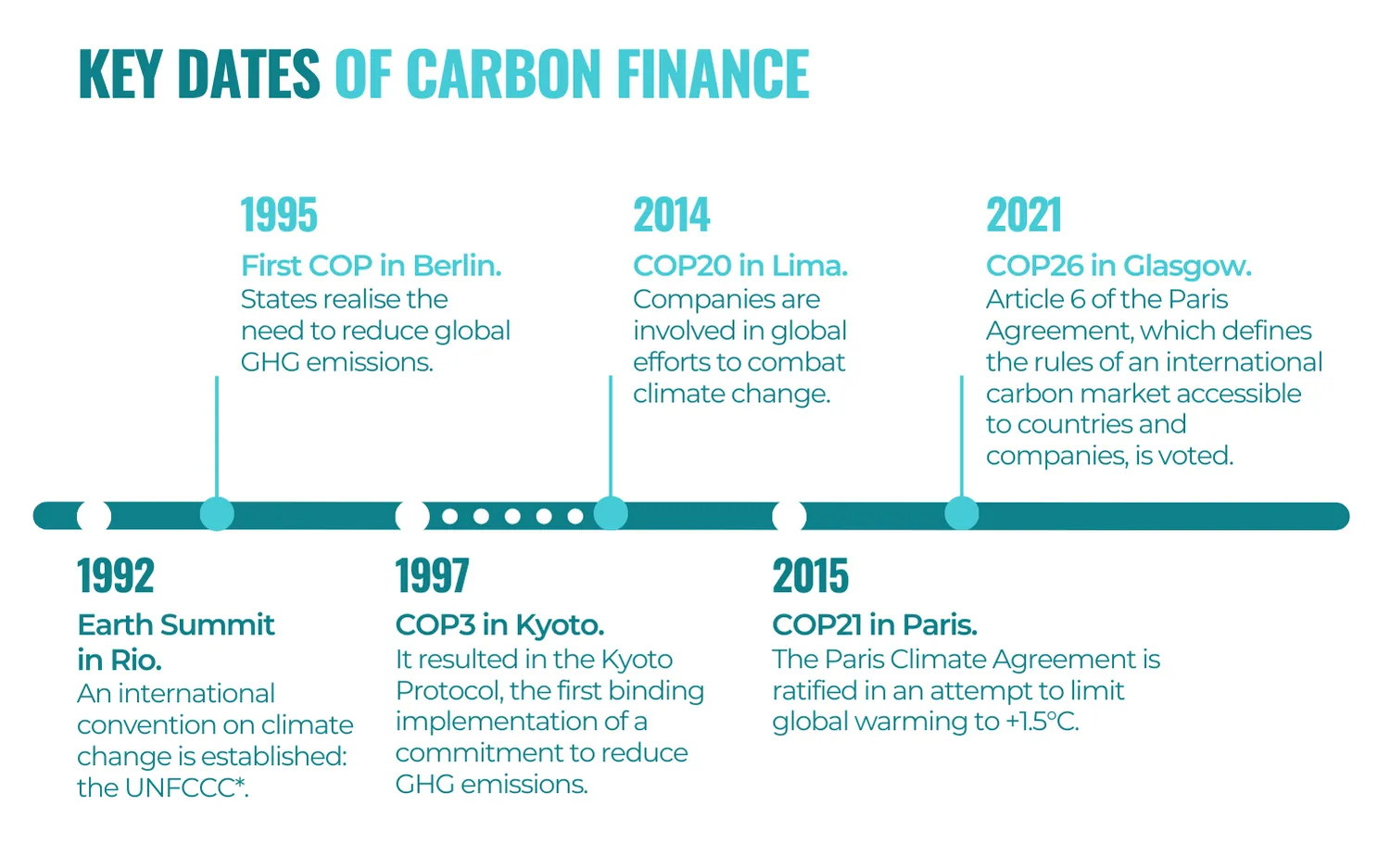

*United Nations Framework Convention on Climate Change.

Carbon markets: multiple applications

Carbon finance is organised around different emission-trading systems governed by regulatory and non-regulatory frameworks. That's why there is currently a wide variety of carbon markets.

It is important to distinguish between two main types of mechanism: regulated emissions trading schemes and "carbon offsetting" voluntary markets operating through the sale of "carbon credits".

Regulated or 'compliance' carbon markets»

For the first time, the 1997 Kyoto Protocol imposed binding GHG reduction targets on the richest countries. To support governments in achieving these targets, the regulations provided for the creation and deployment of three UN-recognised carbon markets*, including the International Emissions Trading Scheme (ETS) which was independently adapted by certain regions or countries in the world.

* 1 - the International Emissions Trading System (ETS), 2 - the Clean Development Mechanism (CDM) and 3 - Joint Implementation (JI).

The European Emissions Trading Scheme

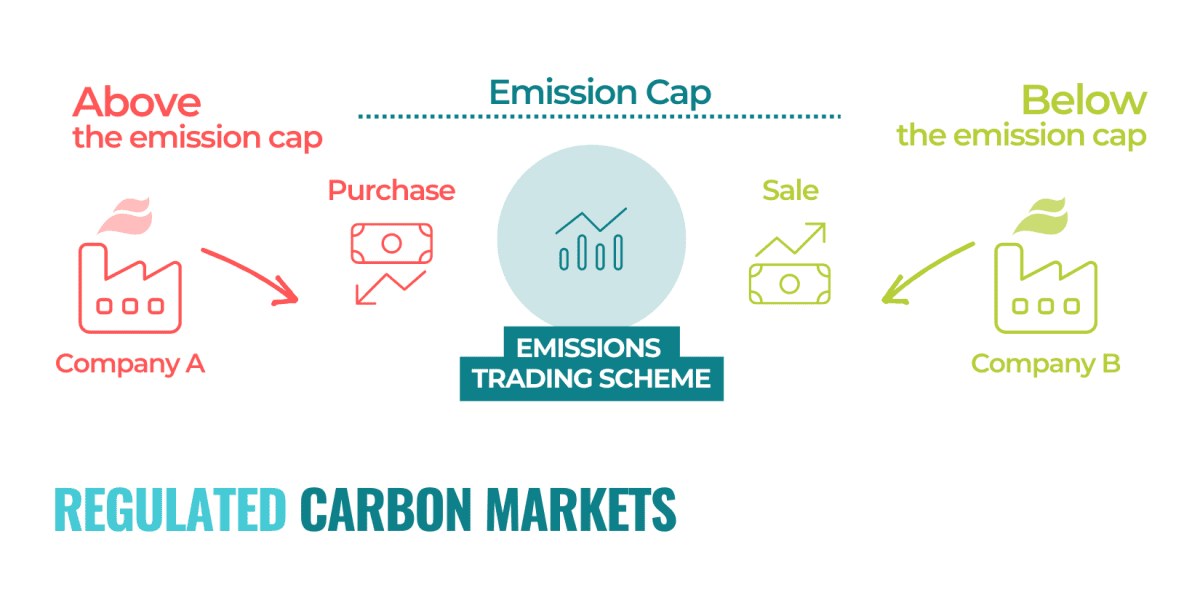

While some twenty national and international markets have been created since then, the largest regional carbon market was created in Europe in 2005, called the EU Emissions Trading Scheme (EU ETS). This Europe-wide standardised tool has enabled a carbon emissions cap to be assigned to each industry by allocating a maximum number of "allowances" that must not be exceeded. This is known as the "cap and trade" principle.

The industries concerned by the regulation are the most polluting (electricity, oil refining, aviation, etc.) and account for around 50%* of EU emissions. They each have a number of "allowances" or EUAs (European Allowances) that they are entitled to emit for a given period. If they manage to reduce their emissions below the corresponding threshold, they can sell their unused allowances. Conversely, if a large company emits more GHGs than the permitted limit, it must buy allowances from other organisations which can sell their surplus. The "polluter pays" philosophy aims to encourage companies to invest in less polluting practices so that they don't have to pay to comply.

Each ETS has its own rules, both in terms of industries covered and in terms of reduction targets. This is why carbon prices fluctuate around the world, in addition to responding to the principle of supply and demand. In the European market, the cost of an "allowance", corresponding to one tonne of carbon, has reached €80 by 2022.

*Source: Ministry of Ecological Transition

The voluntary carbon market

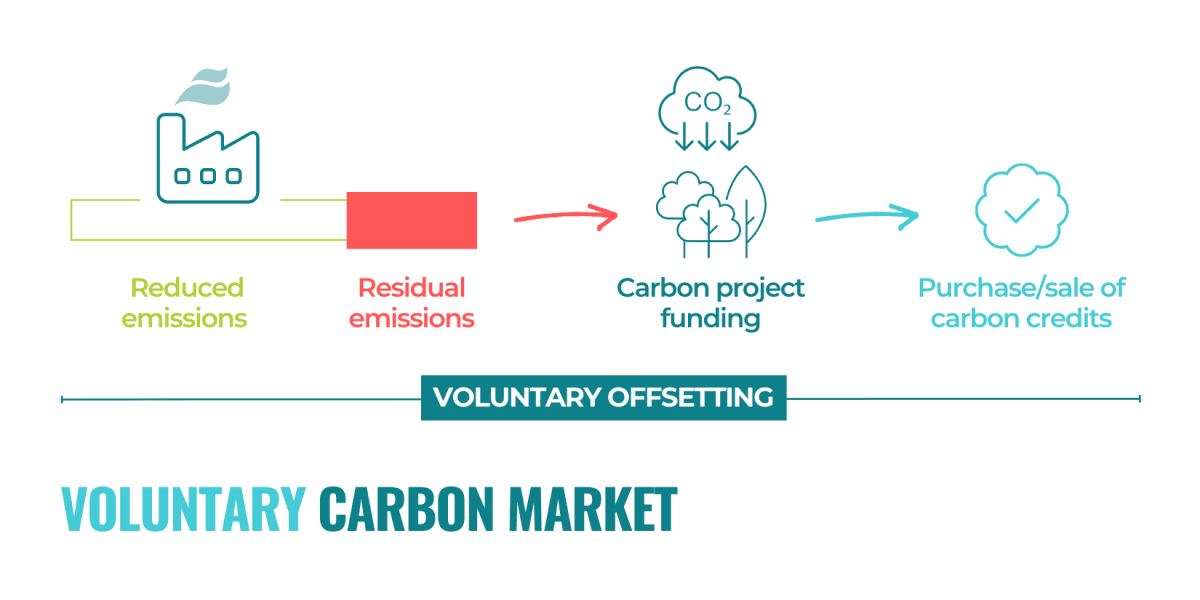

A so-called "voluntary" carbon market, governed by no public institution, has developed worldwide outside the regulated markets. While the UN carbon markets aimed to help governments meet their national targets, this new instrument offers companies (and to a lesser extent individuals) the opportunity to contribute to global carbon neutrality outside their value chain.

The "carbon offset" mechanism

On the voluntary trading market, companies buy carbon credits by financing environmental projects. This is commonly referred to as "carbon offsetting". This involves at least two stakeholders: the funder and the owner of the financed carbon project.

However, the "offset" principle wasn't invented by the voluntary market, since it also governs two of the three markets established by the Kyoto Protocol in 1997: the Clean Development Mechanism (CDM) and Joint Implementation (JI). The latter allowed countries to offset their carbon footprint through the purchase of recognised carbon credits outside their borders.

With 30.7 million* carbon credits sold worldwide in 2021, the voluntary carbon market has increased by 54% compared to 2020.

*Source : “État des lieux de la compensation carbone en France” – INFCC, 2022.

Carbon credits, or climate units

For the sake of harmonisation, carbon markets all use the same international trading currency called "tonne of CO2 equivalent" (tCO2e)* to which is assigned a variable monetary price. A regulatory "allowance" is equal to the right to emit one tonne of CO2 equivalent. Meanwhile, in offset markets, a carbon credit corresponds to one tonne of carbon avoided or absorbed.

By driving significant financial flows towards the fight against climate change, "carbon credits" from the voluntary market have become the cornerstone of carbon finance, acting as a powerful economic incentive to contribute to global carbon neutrality.

Quality standards for carbon credits

Regardless of the certification method used, a carbon credit must meet 6 basic criteria to be allocated to a climate project. It must be:

1 - Additional: GHG sequestration and/or absorption would not have occurred without the sale of carbon credits.

2 - Real: climate benefits are verified and accounted for. The carbon credits issued represent emission reductions that have already occurred.

3 - Measurable: the carbon stored is quantified according to a known methodology approved by an international standard.

4 - Unique: the carbon credit is recorded in a single register to avoid double counting problems.

5 - Permanent: the carbon storage is guaranteed to be permanent and irreversible for a minimum of 30 years.

6 - Independently verified: carbon credits are based on third-party audits and correspond to the amount of carbon actually stored or avoided thanks to the project.

* Other GHGs than CO2 are concerned. Six gases are taken into account: carbon dioxide, methane, nitrous oxides, hydrofluorocarbons, per-fluorocarbons and sulphur hexafluoride. There is a conversion table for these gases into CO2.

A carbon credit for every market

Whether regulatory or voluntary, each carbon market features its own emissions reductions. These reductions therefore have different names depending on the market. Let's take the case of carbon credits sold on the voluntary market: they are certified by international standards, the two best known of which are the Gold Standard, which provides VERs (verified emission reductions), and Verra, which delivers VCUs (verified carbon units).

In France, the Ministry of Ecological Transition has established a voluntary climate certification framework that values and certifies the emission reductions or ERs achieved by offset projects on French territory: this is called the Label Bas Carbone (LBC).

For now, credits from the voluntary market cannot be used by States to meet a regulatory obligation.

Projects funded through carbon offsetting

With the intention of offsetting GHG emissions, two actions are possible: absorbing some of the CO2 already released into the atmosphere or preventing future CO2 emissions from being generated.

There are two main types of "carbon projects" certified under the carbon "offset" framework:

- Carbon sequestration projects are based on the development of natural carbon sinks - through forestry projects, agricultural projects or ocean protection projects - or artificial ones.

- Emissions reduction projects are based on the development of renewable energy, energy efficiency, waste management, improved household equipment, and other techniques that reduce carbon emissions.

Nature-based Solutions (NbS)

Many carbon projects support Nature Based Solutions (NBS). NBSs rely on nature to generate environmental, social and economic benefits. Compared to technological solutions, they represent viable and sustainable economic alternatives to climate change. NBSs alone could contribute to one third of the effort needed to meet the Paris Agreement targets*.

*Source : UICN

As the largest carbon reservoir on Earth, forests are a leading Nature-based Solution for capturing CO2 from the atmosphere. Through several carbon solutions adapted to companies, Reforest'Action is bringing forests to the heart of the voluntary carbon market.

In 2021, 27%* of the credits sold on the global voluntary market came from projects aimed at preserving forests against deforestation and an additional 14% were associated with reforestation and afforestation projects.

*Source : “État des lieux de la compensation carbone en France” – INFCC, 2022.

Article 6: improving the carbon finance accounting system

Since 2021 and the COP26, regulatory carbon finance has been governed by the Paris Agreement, and in particular by its Article 6. It requires all countries, including developing countries, to set ambitious carbon emission reduction targets through a Nationally Determined Contribution (NDC) they are committed to achieve by the end of a given period.

The primary purpose of Article 6 is to improve the accuracy of carbon accounting between different stakeholders, and thus to overcome the current problem of double counting. Double counting refers to the fact that an emission reduction is counted several times, in more than one inventory at the same time.

Article 6.2

This first part defines the establishment of a system enabling the transfer of emission reductions between States. It aims to allow countries that fail to meet their NDCs to purchase mitigation outcomes (ITMOs) from other countries.

To avoid double counting, each ITMO will require a "corresponding adjustment" to be made by the selling country, which will add as many carbon emissions to its inventory as reductions sold.

Article 6.4

This other part of the article offers the possibility to public and private entities to purchase eligible carbon credits from projects that would be certified according to a precise methodology. Following the same pattern as the voluntary offset market, this mechanism regulated by the Paris Agreement will allow for the regulation of carbon credit trading. Discussions on Article 6.4 are still underway before it is actually implemented.

The carbon credits allowed under Article 6.4 will also have to be associated with a "corresponding adjustment" by the country where the carbon project is located. In order to be included in a company's carbon offset strategy, the emission reductions sold in the form of credits will no longer be counted towards the host country's NDC.

Voluntary certification bodies such as Verra and Gold Standard will be able to issue carbon credits in accordance with Article 6.4, thus blurring the line between voluntary and regulatory carbon markets.

Another example of carbon pricing: the carbon tax

Carbon markets are just one of the legal tools used to put a price on carbon. For example, the increase in the carbon tax in France has caused a stir. Despite its name, it is more of a "fee" than a tax. Paid by the users themselves, it has been added to the cost of products and/or services based on fossil fuels (oil, natural gas and coal) since 2014.

Proportional to the use of products and services, this component is intended to act as a "price signal" in order to change the behaviour of individuals, craftsmen and small businesses that are subject to it. Industrialists, on the other hand, must use regulated markets (described earlier in this article) and are not yet concerned by the carbon tax.

This approach is simpler because the carbon price per tonne is set by the government and cannot be adjusted by any market mechanism. In December 2022, the carbon tax price in France was around €45 a tonne.

Carbon finance for global carbon neutrality

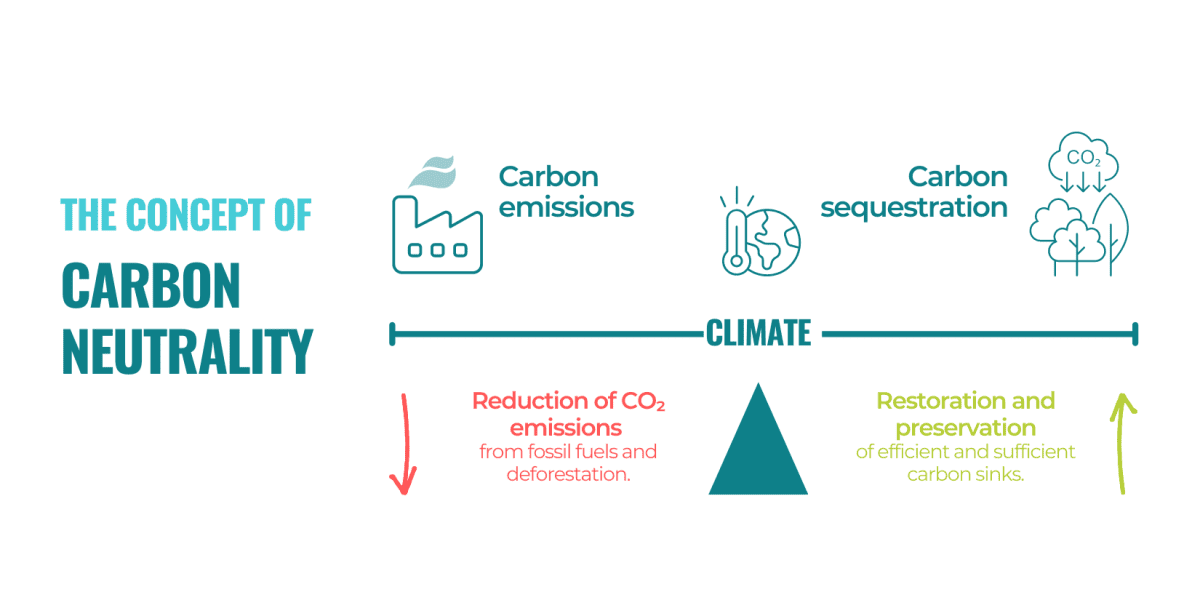

By the middle of the century, the planet will have to be "carbon neutral" as defined by the Paris Agreement in 2015.

Reaching the point of neutrality means finding a balance between anthropogenic greenhouse gas emissions and their sequestration by carbon sinks. To achieve this goal, two complementary actions are needed: reducing GHG emissions and increasing CO2 sequestration in artificial or biological sinks, such as forests. Given the climate emergency, it is imperative to act on both solutions simultaneously.

Contributing to global carbon neutrality

The only carbon neutrality that is strictly recognised by science is global and collective. The challenge of carbon neutrality can only be met at a global level, in a collective contribution way, and can't therefore be limited to its own spectrum.

The drastic reduction of GHG emissions is the top priority. However, in order to adjust the equation and achieve neutrality, we should not be satisfied with an economy that only reduces its footprint. Companies must rethink their relationship to Nature with a holistic perspective to support the emergence of a regenerative economy that has positive impacts on the living world as a whole.

Between historical carbon markets and voluntary offsetting, the complexity of carbon finance - which can lead to its misuse - should not obscure the economic and environmental power of this mechanism.

At Reforest'Action, we believe that carbon finance is not an end in itself, but an essential means of reaching the global carbon neutrality objectives. As a lever for corporate involvement in the fight against climate change, it is even more necessary for the transition to a low-carbon economy. Moreover, the "carbon dimension" cannot stand alone. Wishing to go much further, we are working to develop projects that restore natural ecosystems and provide multiple co-benefits for biodiversity and local communities.

By following the path of continuous improvement, Reforest'Action contributes to the strengthening of processes towards a stronger sense of responsibility and in favour of a collective carbon contribution.