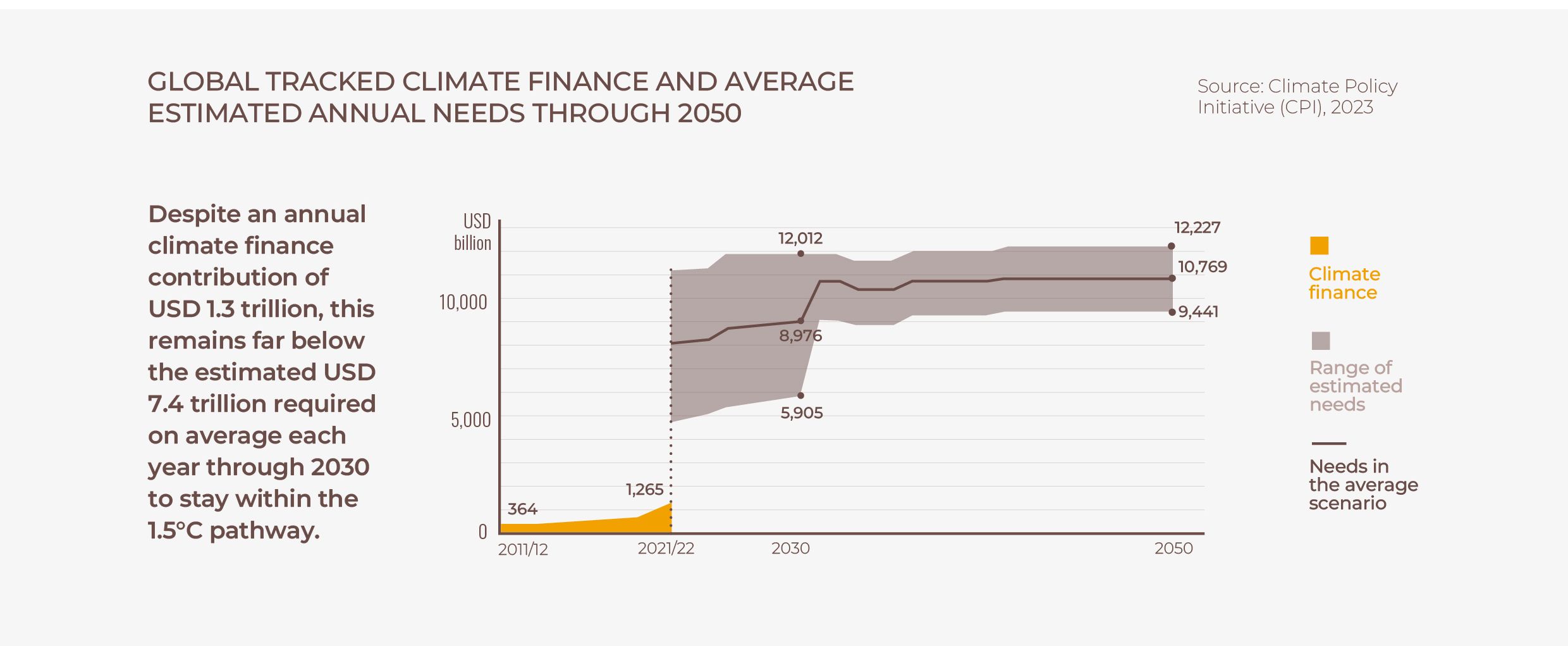

The urgency to act is greater than ever. We are already feeling the devastating effects of a warming planet, with record temperatures, extreme weather events, and rising sea levels. While climate finance remains far below the estimated USD 7.4 trillion required on average each year through 2030* to stay within the 1.5°C pathway, the call to strengthen corporate ambitions has never been more critical.

*Source: Climate Policy Initiative (CPI), 2023

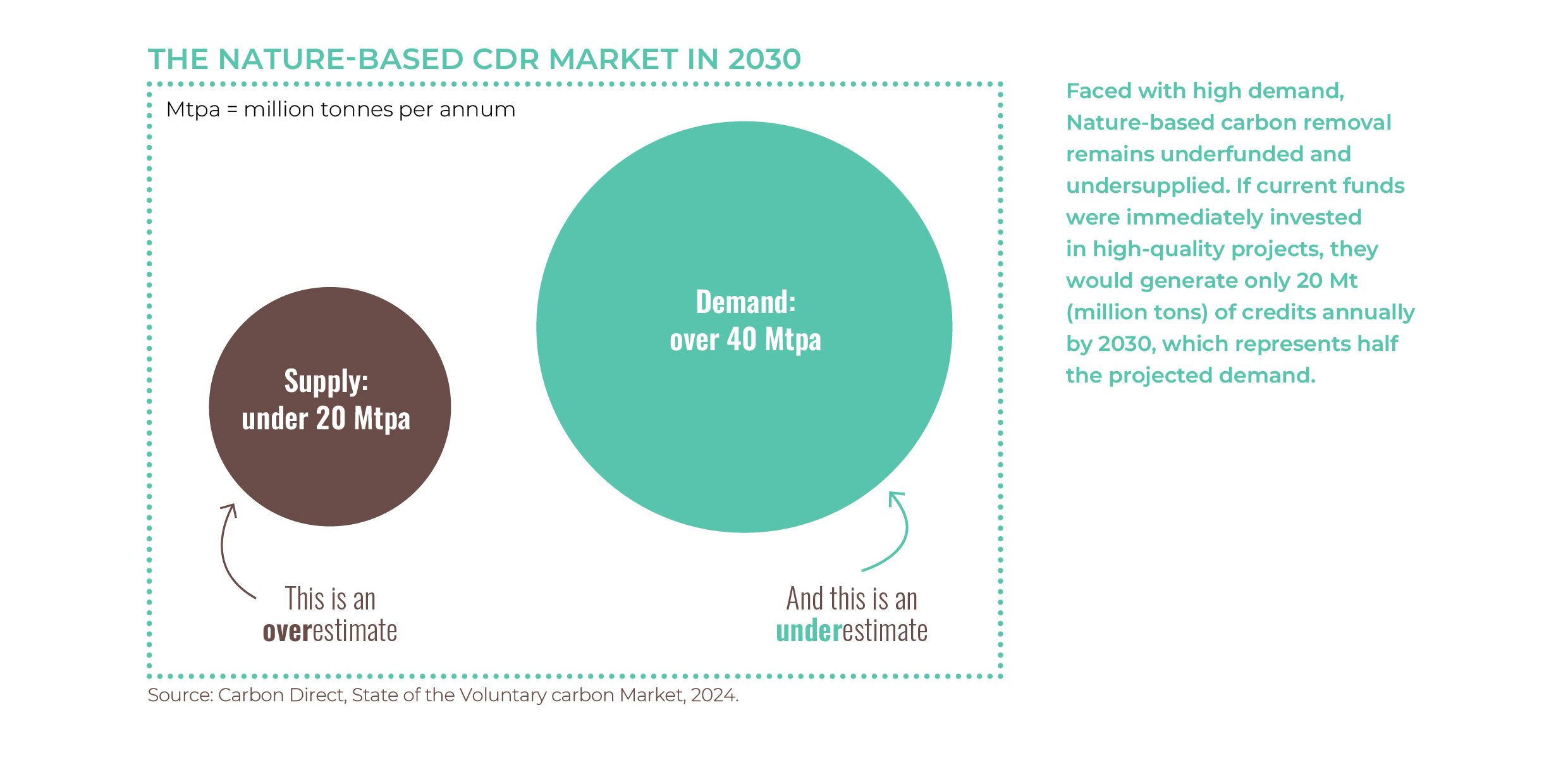

As regulatory pressure intensifies and expectations for corporate climate accountability rise, the Voluntary Carbon Market is approaching a growing imbalance: rising demand is outpacing the supply of high-quality credits. This is especially true for credits originating from nature-based Carbon Dioxide Removal (CDR) projects. Such market dynamics should encourage organization worldwide to accelerate progress on their climate goals by securing high-quality removal credits.

Is your company ready to develop a future-proof carbon offset strategy that harnesses the full potential of Nature-based Solutions? Below are three compelling reasons to start planning now.

REASON #1 Corporate ESG commitments are tightening, deadlines are approaching

Fitting CDR carbon credits into your compliance strategy

Regulatory frameworks are becoming stricter, evolving toward greater clarity and usability, and pushing businesses to evaluate their environmental and social impact across the entire value chain. But reducing emissions across operations presents a complex challenge, particularly for carbon-intensive industries where low-emission technologies may still be inaccessible or cost-prohibitive. That is why carbon finance, and the Voluntary Carbon Market, are valuable tools within a company’s broader climate strategy. While not a substitute for rapid decarbonization, Carbon Dioxide Removal (CDR) offers an effective way to offset unavoidable emissions and meet regulatory compliance.

Keeping pace with net zero targets

One of the clearest examples of mitigation pressure is the SBTi’s Net-Zero Standard, which requires companies to cut emissions by at least 90% by 2050. Since 2022, more than 1,100 business have had their commitments verified according to the standard of the Science Based targets Initiative. With 2030 approaching, businesses can use the SBTi’s Beyond Value Chain Mitigation (BVCM) guidance to build CDR strategies now. BVCM encourages investment in carbon removal and reduction outside the value chain as a meaningful interim step to protect carbon sinks and advance global climate goals.

SBTi research (2023) found BVCM to be the top reason companies purchase and retire carbon credits. As it works on the next version of its Net-Zero Standard, the SBTi is also assessing the role of carbon credits and other environmental attributes in tracking progress or exceeding core targets.

REASON #2 Demand for high-quality carbon credits will surge, supply won’t keep up

Preparing for rising demand and prices

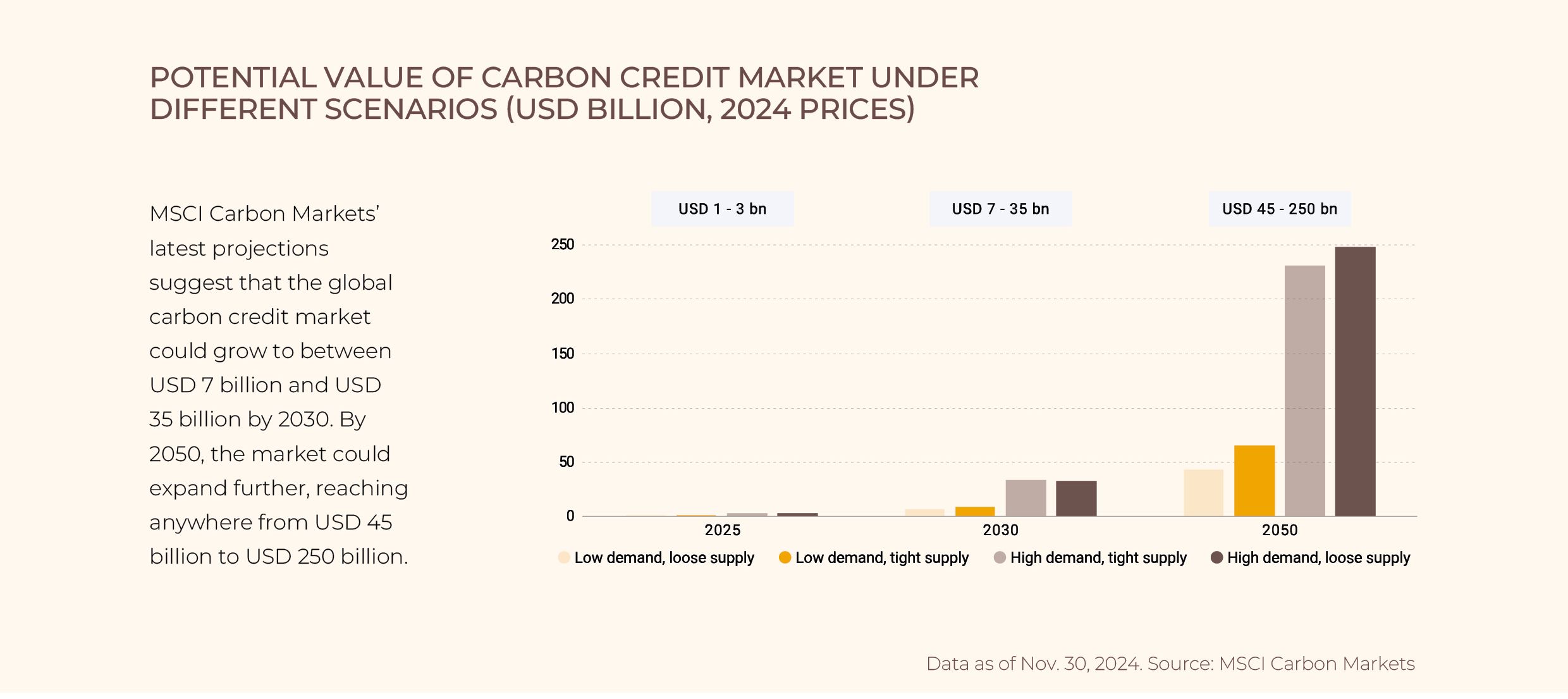

The Voluntary Carbon Market is rapidly evolving as it scales, with standards and projects being financed continuously improving. This progress reflects a healthy, growing market. Experts predict that supply from high-integrity carbon projects will remain constrained until investments scale up to support new projects. On the contrary, as we approach 2030, various factors indicate that demand for high-quality credits will surge. In short, global demand is expected to exceed supply, driving up prices and impacting availability.

Key drivers of demand for high-quality CDR include:

ESG pressure: With over 6,000 companies now committed to science-based targets, and SBTi updates underway, demand for high-quality carbon removals will grow as firms seek to close emissions gaps ahead of 2030 and 2050.

CORSIA compliance scheme: As the aviation compliance scheme CORSIA enters its mandatory phase in 2027, airlines must scale up credit purchases. Projected demand could exceed 100 million credits**, reinforcing the voluntary market.

Article 6.4 mechanism: The Paris Agreement Crediting MECHANISM (PACM) will enable global trading of A6.4ERs, with carbon removals at its core, raising standards and driving volume in the voluntary market.

Financial market integration: Carbon credits are being embedded into green bonds and structured finance, shifting them from speculative to strategic long-term assets and boosting market stability.

National policies: Updated country NDCs*** will push companies toward carbon credit investments to stay ahead of national compliance risks. In parallel, Article 6.2, enabling credit trading between countries, will expand international demand.

*Source: SBTi Monitoring Report 2023 **Source: Abatable’s Voluntary Carbon Market Developer Overview, 2023-2024 report _***NDC: Nationally Determined Contribution _

Understanding key trends that shape the market

Quality, the new imperative: Buyers must prioritize high-quality carbon credits to ensure their investments remain credible and impactful. The trust gap has driven the rise of stricter quality benchmarks. As a matter of fact, the Core Carbon Principles (CCPs) led by the ICVCM* has begun approving carbon credit categories eligible for the CCP label, ensuring credits deliver real, additional, and verifiable impacts for the climate, biodiversity, and local communities.

New investment approaches: Major companies like Microsoft and Meta have demonstrated new ways to engage in high-quality CDR projects with minimal operational risk. Given the limited availability of high-integrity credits on the spot market, offtake contracts have emerged as key indicators of demand for nature-based CDR. In 2024, 0.16 (million tons) high-durability credits were retired on the spot market, versus 6.4 Mt in pre-purchases and offtakes**.

A shift no NbS removals: Removals are expected to grow faster than reduction credits, potentially accounting for two thirds of the Voluntary Carbon Market value by 2050***. Nature-based credits still dominate the current CDR supply, making up 98% of total CDR issued between 2022 and 2024. Symbiosis Coalition has become the first advance market commitment focused on nature-based CDR, highlighting the urgency of securing high-quality carbon removal credits now.

*ICVCM: Integrity Council for the Voluntary Carbon Market **Source: Carbon Direct, 2024 State of the Voluntary Carbon Market ***Source: MSCI Carbon Markets' projections, Data as of Nov. 30, 2024

REASON #3 Not all removals are equal, nature-positive investments matter now

Scaling up investment to meet growing demand

High-integrity NbS encompass a range of project types, such as Afforestation, Reforestation, and Revegetation (ARR), Agroforestry, Improved Forest Management (IFM), Improved Agricultural Land Management (IALM), and Wetlands Restoration and Conservation (Blue Carbon). All together, they represent an emerging area of finance with the potential to provide up to a third of climate mitigation needs by 2030 (UNEP, 2023).

Far greater investment is needed to prevent a prolonged shortage, support corporate climate goals, and scale NbS removals to the billions of tons required for 1.5°C scenario alignment. By investing in nature-based carbon credit, which are ready to scale today, you can meet emerging compliance requirements, manage risk proactively, and position your company as a climate leader in the transition to net zero.

Highlighting the unique strengths of Nature-based Solutions

High-integrity NbS offer key advantages over engineered carbon capture. They can support both mitigation and adaptation, while addressing multiple crises and delivering positive impacts on communities and ecosystems, aligned with the Sustainable Development Goals (SDGs). NbS are ready to scale now, allowing for immediate action, and are relatively inexpensive compared to engineered carbon capture and storage methods.

On the other side, over-reliance on engineered solutions can be costly and restrictive, making it essential to recognize the broader benefits of NbS. Direct Air Capture (DAC) demand high energy, potentially increasing carbon emissions, and may have negative ecological impacts before extensive research is conducted. Besides, carbon reductionism can become increasingly binding, limiting the long-term viability of most technical solutions. A market-driven approach that values the core benefits and structural strengths of NbS will help ensure a more balanced allocation of capital.

Are you interested in investing in a high-quality nature-based carbon removal project? Download our investors’ guide to find out Why and how to build your offset strategy now with nature-based carbon removals.