Scaling up investment to meet growing demand

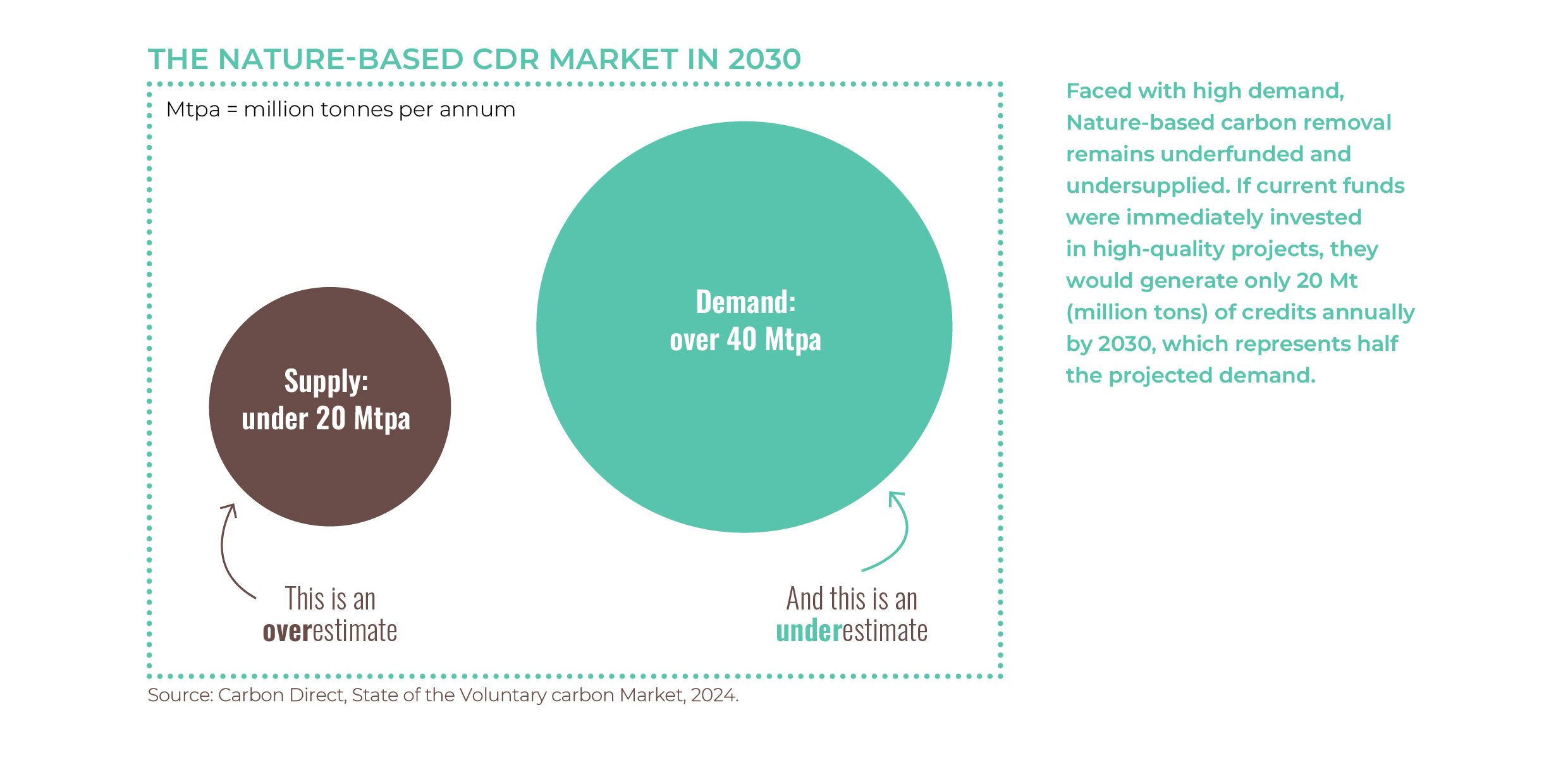

The Voluntary Carbon Market (VCM) is evolving rapidly as it scales. With ESG regulations tightening, Paris Agreement Article 6.4 mechanisms advancing, and CORSIA entering its first mandatory phase, 2025 marks a critical turning point. These developments signal growing confidence but also mounting pressure. Experts forecast that while demand for high-integrity credits will rise sharply, supply will remain constrained unless investments increase significantly to support project development. As we move toward 2030, global demand is expected to outstrip supply, pushing up prices and reducing availability, especially for high-quality credits, which already represent less than 10% of the market*.

Nature-based removals matter now

Corporate buyers are increasingly prioritizing premium credits, and Nature-based Solutions (NbS) are a key focus. Since 2018, nearly USD 11 billion has been committed to nature-based CDR*, with 60% going to forest-based projects. Major buyers like Microsoft and Meta have already secured large offtake agreements to meet their 2030 targets. This underlines confidence in NbS, but more investment is essential to scale solutions to the billions of tons required for 1.5°C alignment.

*Source: Carbon Direct, 2024 State of the Voluntary carbon Market

Investors must now recognize that waiting for perfect conditions means missing today’s opportunity to shape tomorrow’s solutions. Unlocking the full potential of nature-based CDR requires proactive, long-term financial and technical support across all phases of project development. Below are the key levers to invest without delay and lock in both the volume and price of your carbon credits.

LEVER #1 Pre-purchasing ex-ante carbon credits

As demand for high-quality carbon projects accelerates, sustainability leaders must proactively manage future risks related to credit availability and pricing. At the same time, project developers require early financial support to launch and scale impactful initiatives while signaling market stability.

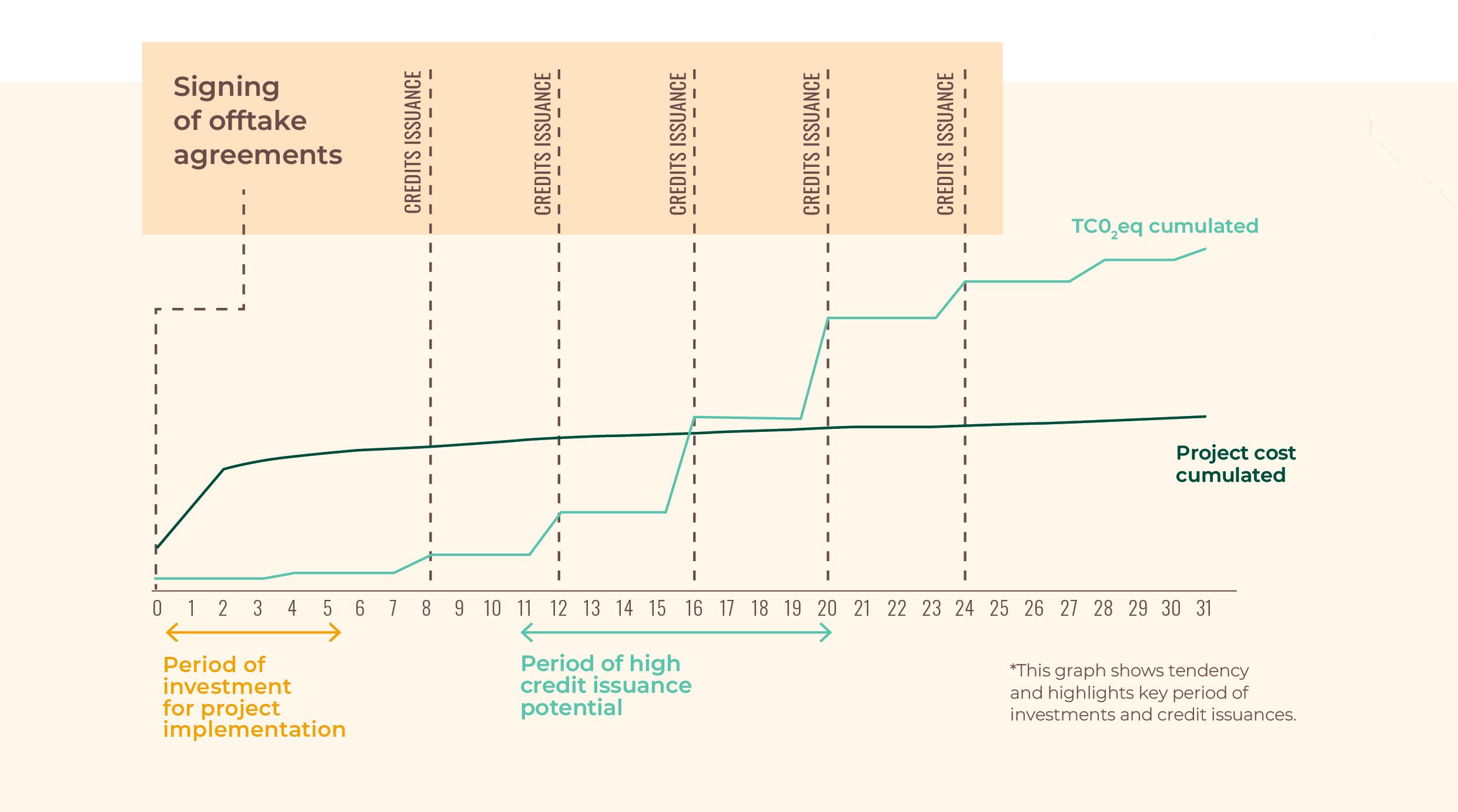

Offtake agreements are legally binding contracts in which buyers commit to purchasing a specified volume of carbon credits at a fixed price over a defined period. They emerging as strategic tools that serve both sides. Whether structured with or without prepayment - which can provide crucial early-stage funding for project development - these agreements align with long-term climate strategies.

Strategic advantages of offtake agreements:

Securing quality and price stability: Offtake agreements help manage supply and price risks, ensuring buyers secure high-quality, verifiable credits at competitive rates.

Mitigating operational risk: Offtake agreements shield buyers from project risks. If the project fails to deliver the expected credits, the buyer pays nothing.

Unlocking new supply: By helping project developers attracting early-stage funding, offtake agreements accelerate the growth of high-quality carbon credit supply.

LEVER #2 Investing in a nature-based CDR project

Significant time and resources go into project selection and due diligence. An alternative is direct investment in carbon projects, funding their development from the outset. For example, a company seeking a large supply of high-quality NbS credits could invest in an early-stage reforestation project, financing its initial phases while securing all credits generated by the project in the future.

The value proposition of project investment:

Securing exclusivity and priority: For companies seeking large volumes of carbon credits, investing in a project can grant exclusive access to a guaranteed supply, often at a significantly lower price*. *Compared to market forecasts for the coming years

Influencing project development: Investing in a project fosters a closer relationship with the project developer, allowing buyers to actively collaborate on project design while aligning it with their sustainability goals.

Creating added value and new revenue opportunities: By securing carbon credits at a lower price, buyers may have the option to sell them later at a profit, or to use them to finance the monitoring phases of the project. This is referred to as self-financing.

Integrating direct investment and offtake agreements into the project development curve

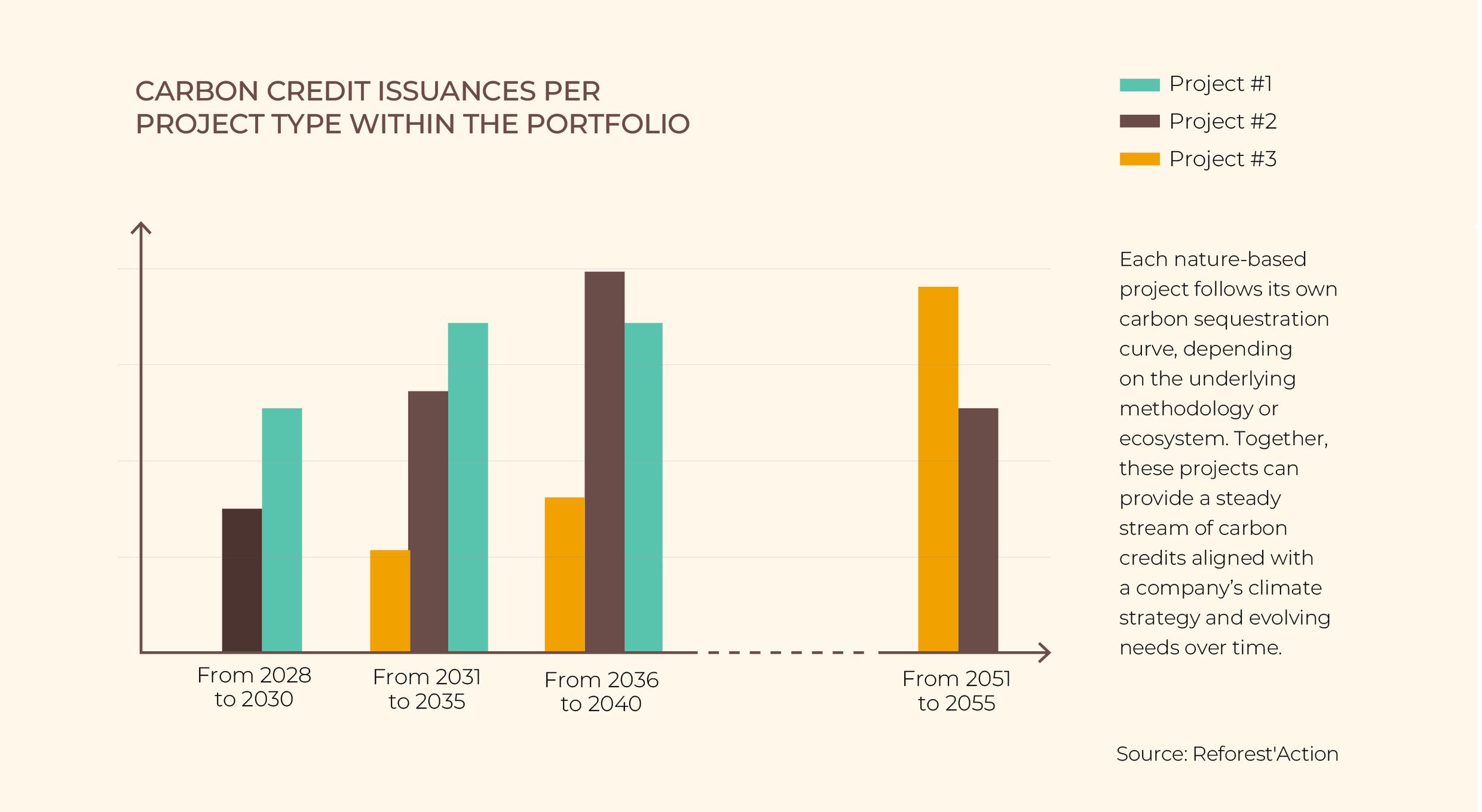

LEVER #3 Spreading risk through a portfolio-based carbon strategy

Diversifying a company’s carbon credit portfolio is a key strategy for managing risk. By spreading investments across multiple nature-based projects - varying in methodology, geography, carbon removal potential, and socio-environmental core benefits - companies can reduce exposure to risk while maximizing overall impact. Taking a long-term approach to portfolio construction allows companies to allocate funds strategically, while integrating the benefits of both offtake purchases and project investments.

In a rapidly evolving carbon market, businesses must anticipate and integrate carbon removals within their strategy from the outset. Waiting until emissions reductions alone are no longer sufficient can leave companies exposed to rising costs, regulatory pressure, and supply constraints. Besides, high-quality nature-based projects take years to develop, with many requiring 5–10 years before issuing credits. Delayed action increases the risk of limited access to premium carbon credits.

By building a forward-looking multi-year strategy and integrating offtakes agreements or project investments into their sustainability strategy, organizations can enhance long-term planning, budgeting accuracy, and potentially achieve significant cost savings on carbon removals.

Are you interested in investing in a high-quality nature-based carbon removal project? Download our investors’ guide to find out Why and how to build your offset strategy now with nature-based carbon removals.